Tax Control Framework

Reducing and controlling fiscal risk is now possible

The management and control of 'tax risk' is always a topical issue. Irrespective of the tax burden, there is an increase in both pecuniary damage, associated with non-compliance sanctioned by the competent authorities, and reputational damage, which often disregards the outcome of litigation in the courts.

The flow of information that control systems have to analyse is constantly increasing, considering also that those who have the information do not always have the necessary tax sensitivity and vice versa. This makes it difficult to identify tax-relevant flows.

Existing control structures often ignore this type of risk in their processes, and primarily focus on the risk of non-compliance, without undertaking an analysis of tax risks related to the specificities of the business.

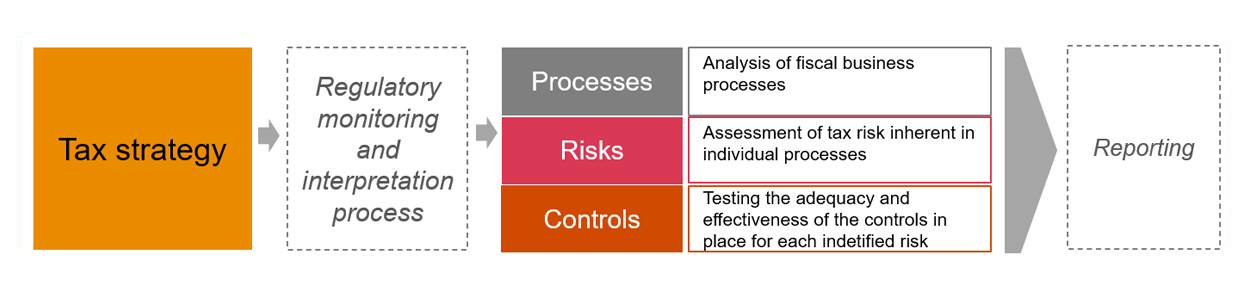

The Tax Control Framework

Is Tax Control Framework the right solution for you?

The Tax Control Framework is available to all companies with operations in Italy. Whether you are a leading international group, a medium or large organisation, if you intend to build a solid system to control risks, including tax risks, this tool will help you achieve this goal. You can use the tool to carry out an initial self-assessment which will allow you to concretely start control activities.

Features and Benefits

Support in the management of Interpretation Risk (IR) and Compliance Risk (RCM) through an organisational and procedural approach based on its own reality.

Flexibility in adding removing changing risks and/or controls within the matrix.

Management of modular and optimal planning of control and risk assessment activities.